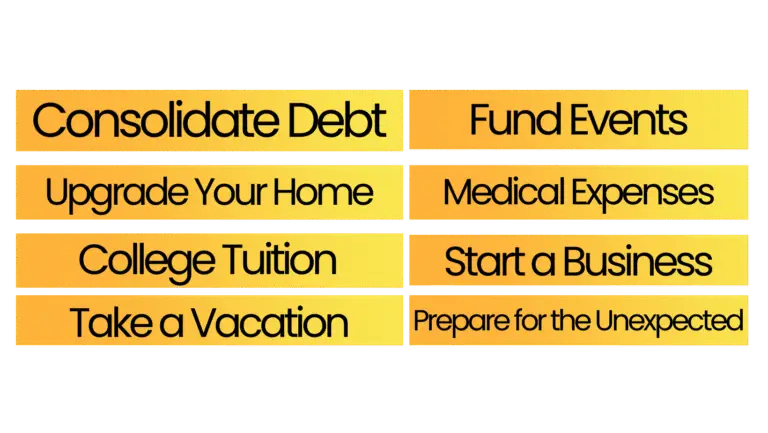

A HELOC (Home Equity Line of Credit) is a flexible, revolving line of credit that lets you borrow against the equity in your home. Use your funds as needed! Whether for home improvements, debt consolidation, or other major expenses—only paying interest on what you use. Find out what a HELOC can do for you!

LOAN TYPE

TERMS

FED PRIME RATE*

HOME EQUITY LINE OF CREDIT

(VARIABLE RATE)

MINIMUM $10,000.00

Maximum $100,000.00

180 MONTHS (15 YRS)

6.750%

*RATE BASED ON FED PRIME RATE and FICO SCORE TIER ( PRIME +/- ) FOR ADDITIONAL INFORMATION CONTACT OUR CREDIT UNIONS LOAN OFFICER

120-month term payment example: A 10-year loan at 7.50 fixed APR with zero down payment will have 120 monthly payments of $20.05 per each $1,000 borrowed. All rates, terms and promotional offers are subject to change without notice. Cannot be combined with any other offer. Restrictions may apply, ask for complete details. *APR=Annual Percentage Rate. **Home Equity Line of Credit annual fee of $50.00

FAQ

What's the Difference Between a Home Equity Loan and a HELOC?

A HELOC Loan focuses on a revolving line of credit. A Home Equity Loan is a large “lump sum” loan.

Are There Any Fees Involved?

Yes, we do require an annual fee of $50.

Can I Lose My Home If I Default On a HELOC?

While yes your home is used for collateral, your home is safe as long as you continue making monthly payments.